Live Nation made two intriguing financial announcements on Wednesday (May 13).

The first indicated that the company intended to secure $800m in senior debt, via a secured note sale, with repayment due in 2027.

Then, around 12 hours later, LN announced that this debt load was being increased, to $1.2bn, again for senior secured notes due 2027 (with an an annual interest rate of 6.5% per annum). The note sale closes May 20.

Live Nation told its investors that this $1.2bn would be used for “general corporate purposes”.

Speaking earlier this month on an earnings call, Live Nation CEO & President Michael Rapino noted that, as of May 7, his company had a free cash balance of $817m, combined with $963m in undrawn debt capacity.

This money, $1.78bn in total, would be enough, said Rapino, for Live Nation to “maintain critical operations for the remainder of the year, even in the extreme scenario that no major shows play off [in 2020]”.

That’s an important statement, because right now (since March 12) Live Nation is not hosting a single concert worldwide due to COVID-19, meaning every day that ticks by is doing so without the company’s main source of income.

Adding on another $1.2bn in secured note-related debt to the $1.78bn would take that cash pile up close to $3bn.

(The $1.78bn mentioned by Rapino excluded another $2bn in “event-based deferred revenue” owned by Live Nation (as of March 31), which includes money paid by fans for tickets to shows that haven’t yet happened and/or have been postponed.)

On the same Q1 earnings call on May 7, Live Nation President Joe Berchtold noted that, thanks to recent cost-savings efforts, Live Nation has an “operational cash burn rate of approximately $150m per month for the rest of the year, prior to interest expense, debt payments, capital expenditures and other nonoperational items”.

A $150m-per-month burn rate would mean the $1.78bn pile cited by Rapino ($817m cash plus $963m undrawn debt) would last Live Nation between 11 and 12 months – i.e. to the end of Q1 2021.

At the $150m-per-month burn rate suggested by Berchtold, acquiring $1.2bn in additional debt would give Live Nation approximately another eight months of liquidity, discounting any future income that may occur.

Live Nation’s turnover should obviously pick up later this year, if it is able to sell tickets to newly announced shows scheduled into 2021.

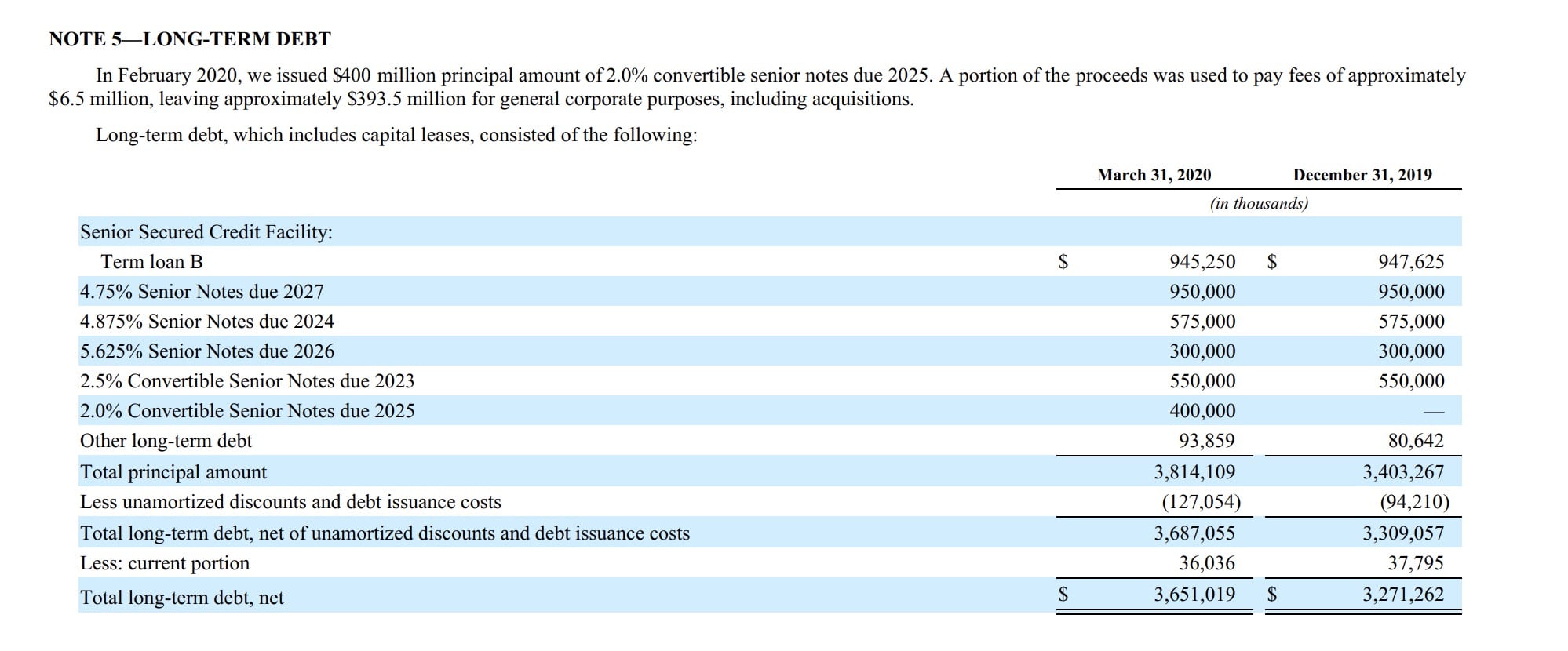

A $1.2bn secured note sale will take Live Nation’s long-term debt up to approximately $4.85bn (see below for LN’s published debt list as of the end of Q1 2020).

The first tranche of this debt owed for recoupment is convertible notes due in 2023, worth $550m.

Last month, ahead of its Q1 earnings, Live Nation announced it had secured a $120 million revolving credit facility loan to boost its liquidity.

At the same time, the company announced plans for $500 million in cost cuts this year, including salary reductions for Michael Rapino and other top executives.

Live Nation confirmed on May 7 that this $500m target had been met, and had been raised to $600m (i.e. $50m per month).

Live Nation’s Q1 2020 revenues fell significantly in Q1 (the three months to end of March) by 20% YoY.

The firm’s Concerts quarterly revenues were particularly affected, down 24% YoY at constant currency to $993.4m.Music Business Worldwide

No comments:

Post a Comment