The MBW Review is where we aim our microscope towards some of the music biz’s biggest recent goings-on. This time, we sift through Goldman Sachs’ new 80-page paper on the music business to see what the future holds. The MBW Review is supported by Instrumental.

The MBW Review is where we aim our microscope towards some of the music biz’s biggest recent goings-on. This time, we sift through Goldman Sachs’ new 80-page paper on the music business to see what the future holds. The MBW Review is supported by Instrumental.

The Goldman Sachs’ Music In The Air report has become a highly influential paper for prognosticators chewing over the entertainment industry. The report is written by top analysts at the investment bank, led by Lisa Yang, Goldman’s London-based Managing Director, Media & Internet.

Last summer – foreshadowing the sale of 10% of Universal Music Group for $3.4bn to a Tencent-led consortium months later – Goldman triggered fiscal excitement around the industry by upping its previously-published Music In The Air forecasts, suggesting that the number of paying subscribers to music streaming services would hit 1.15bn by 2030.

Now, in a new update to Music In The Air published Friday (May 14), Goldman has, in the light of the COVID pandemic – but also in light of recently published stats from IFPI – made some adjustments to its predictions, with a mix of good and not-so-good news for artists, labels, songwriters and publishers.

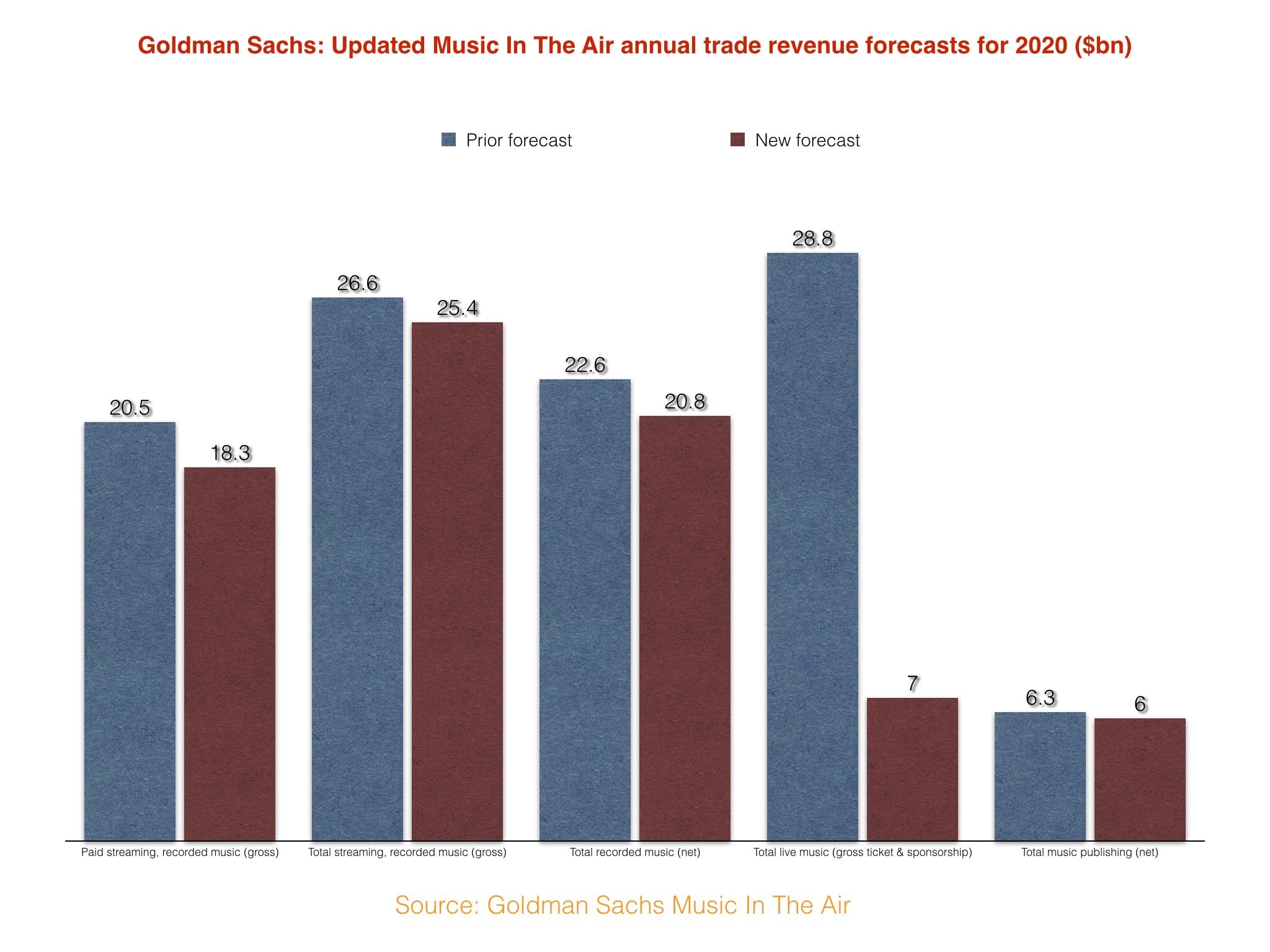

With a sub-head of The Show Must Go On, Goldman’s Music In The Air now forecasts that total global record industry net/wholesale revenues will reach $20.8bn this year.

That’s up by 3%, or $600m, on the $20.2bn wholesale figure the record industry generated in 2019 (source: IFPI). But, says Goldman, it’s also down by 8% – or by $1.8bn – on the financial group’s prior forecast ($22.6bn) for this year.

You might assume Goldman’s 2020 forecast reduction is simply due to the expected negative impact of COVID-19 on record business income streams like licensing, physical sales and streaming ad revenues, and it’s true that the pandemic certainly plays a role in the calculation.

“For recorded music, we forecast c.3% growth in 2020, marking the first year of meaningful slowdown since the market returned to growth in 2015, as we expect the growth in streaming will be offset by weaker physical and licensing revenue.”

Lisa Yang (pictured) & team, Goldman Sachs’ updated Music In the Air

Lisa Yang and co. write: “For recorded music, we forecast c.3% growth in 2020, marking the first year of meaningful slowdown since the market returned to growth in 2015, as we expect the growth in streaming will be offset by weaker physical and licensing revenue.”

Yet Goldman has also wiped $2.2bn, specifically, off its forecast for the amount of money consumers will spend on paid streaming in 2020 – down from a prior prediction of $20.5bn to $18.3bn.

This cut obviously warrants further examination.

[Important side-note: Goldman’s overall recorded music forecast is based on industry/wholesale revenues; its streaming forecasts, however, are now based on retail spend, not just the record industry’s cut, which means these two sets of numbers are not apples-to-apples.]

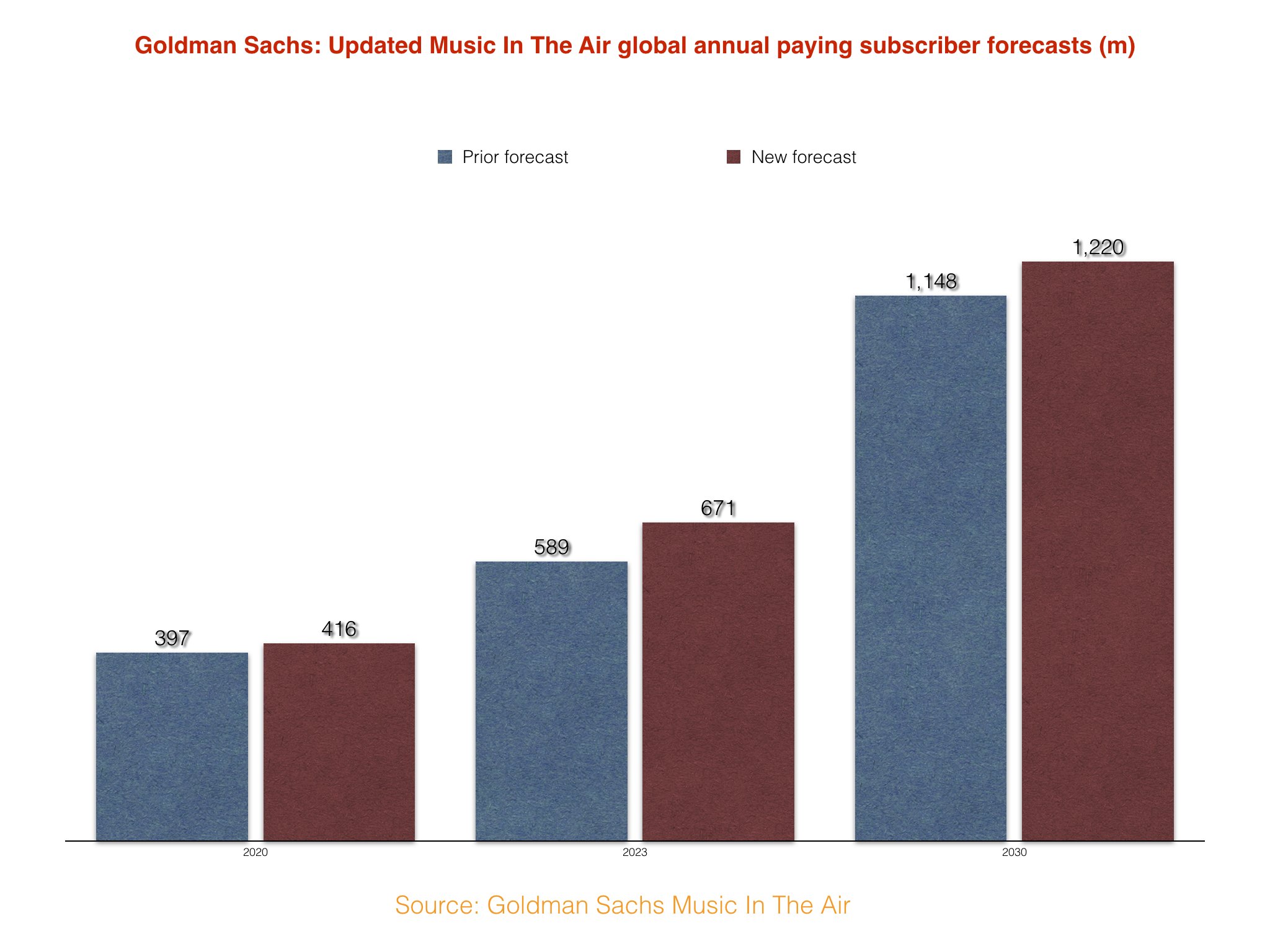

So, Goldman has moved its prediction for streaming revenues down by over two billion dollars for 2020. But what about its forecast for the number of paid streaming subscribers we’ll see this year worldwide?

So, Goldman has moved its prediction for streaming revenues down by over two billion dollars for 2020. But what about its forecast for the number of paid streaming subscribers we’ll see this year worldwide?

Interestingly, that’s actually gone up, increasing from a prior forecast of 397m to 416m. That 416m figure in turn represents a jump of 75m on the official tally of music streaming subs seen in 2019 (341m).

This obviously suggests that, in Goldman’s mind, COVID-19 won’t materially reduce the projected number of streaming music subscribers, globally, this year. (Indeed, the 75m annual subscriber increase projected in 2020 is actually a bigger jump than that (+69m) suggested in Goldman’s previous forecast.)

So if that’s the case, why does Goldman Sachs thinks paid streaming revenues are going to take such a hit from what it previously predicted?

Part of the answer to that question lies in 2019, when the global recorded music industry’s paid-for streaming revenues (on a retail basis) were $15.5bn – some $1.3bn smaller than Goldman’s prior prediction.

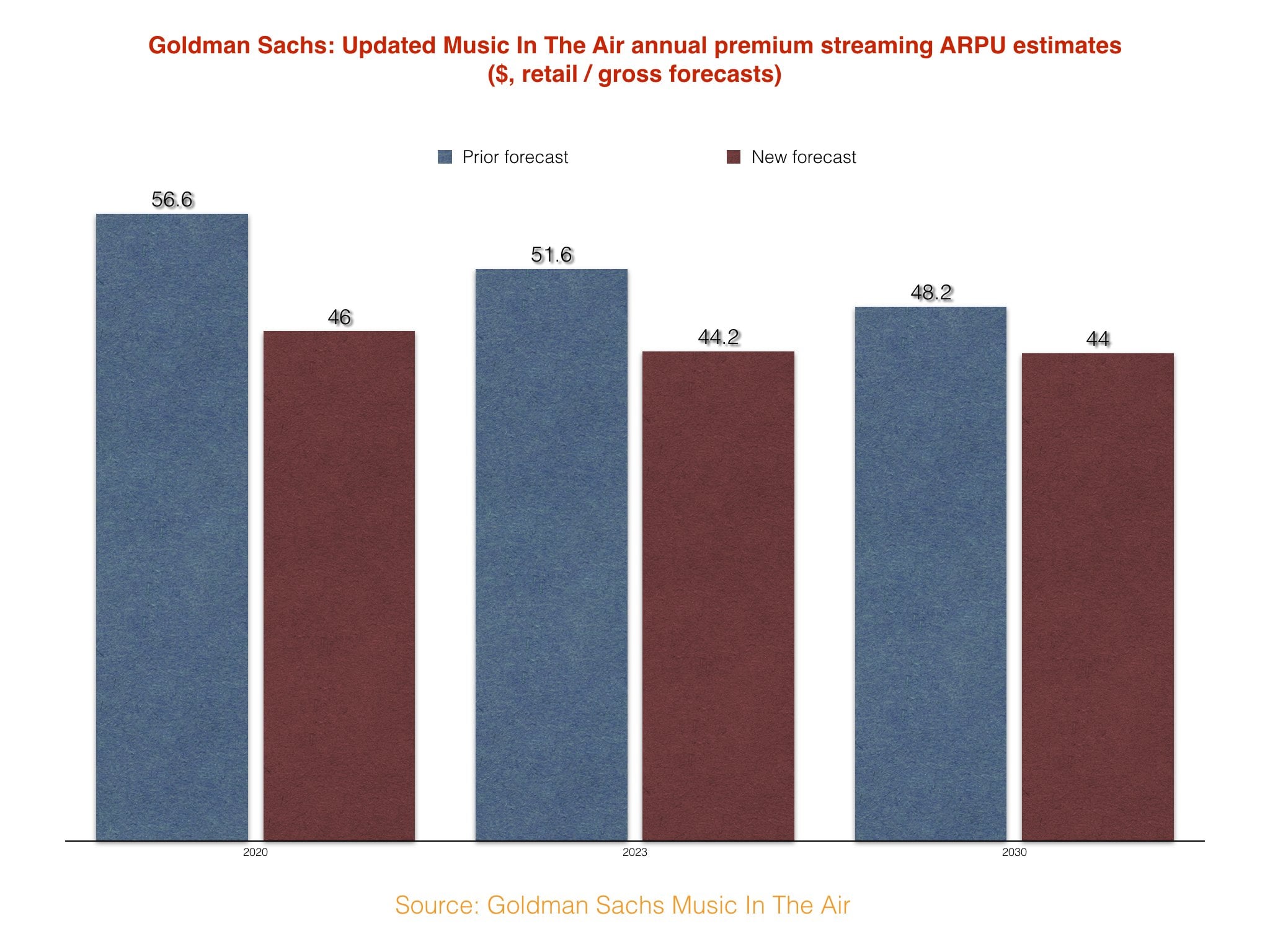

But another, very significant part of the same answer points to MBW’s topic du jour, Premium streaming ARPU (Average Revenue Per Premium User).

MBW has written twice about ARPU in recent weeks: once when Spotify’s fell 7% year-on-year in Q1 2020, down to below $5 per month for the first time, and once when Daniel Ek’s company launched a three-months-Premium-for-free deal (which seems guaranteed to lower that ARPU number yet again in Q2).

MBW has written twice about ARPU in recent weeks: once when Spotify’s fell 7% year-on-year in Q1 2020, down to below $5 per month for the first time, and once when Daniel Ek’s company launched a three-months-Premium-for-free deal (which seems guaranteed to lower that ARPU number yet again in Q2).

We also noted, following the publication of the IFPI’s latest Global Music Report, that the industry’s worldwide annual ARPU for paying music subscribers last year sat at approximately $24.87 (or $2.07 per month).

Essentially, because this 2019 ARPU figure was significantly lower than that expected by Goldman Sachs, its analysts have now adjusted their own ARPU predictions (which cover gross/retail revenues, rather than IFPI’s industry net/wholesale revenues) accordingly.

In 2019, says Goldman, global paid streaming ARPU levelled out at $51.90 on an annual retail basis (i.e. $4.33 per month), down from the firm’s prior projection of $57.50 ($4.79 per month).

Partly as a result of this change, Goldman Sachs now believes the average music streaming subscriber worldwide in 2020 will pay over $10 less per year than it did previously – down from $56.60 ($4.72 per month) to $46.00 ($3.83 per month).

Goldman has essentially re-aligned its projections for the future of paid streaming in light of what actually happened in 2019, which obviously seems eminently sensible.

It does, however, mean that Goldman’s projected paid music streaming ARPU for a decade’s time – in 2030 – also falls, to $44 per year (i.e. $3.67 per month), reflecting, says the company, “greater dilution from [emerging markets], family plans and bundles”.

How concerned record labels and artists are about this forecast ARPU decline will rather depend how they also feel about the more positive predictions contained within Goldman Sachs’ updated new paper.

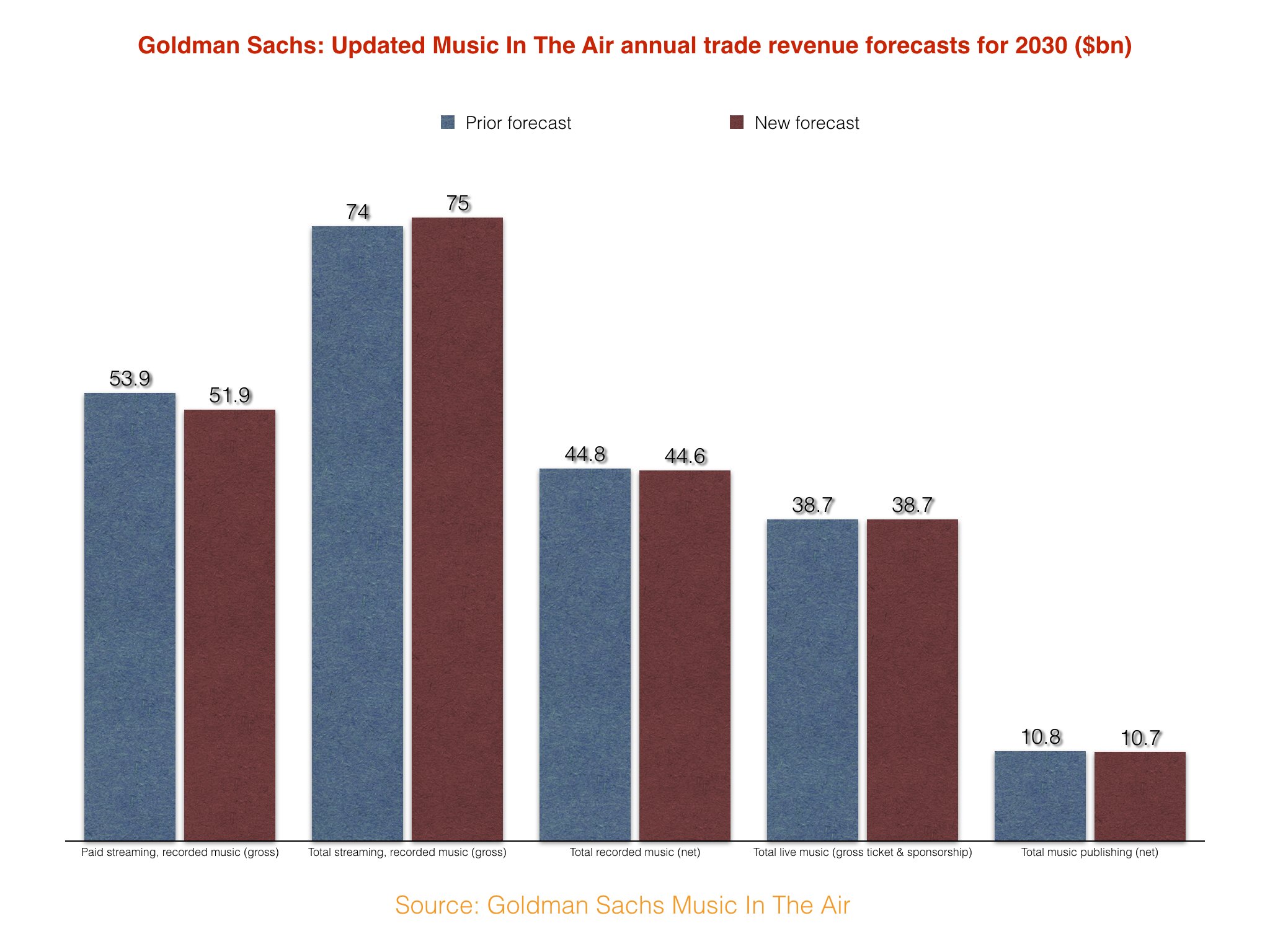

Despite the paring down of its 2020 predictions for recorded music revenues, Goldman Sachs now forecasts that 2030 will generate very close to the same amount of money for the music business that it previously suggested.

That’s largely because of a much rosier outlook for ad-funded streaming which, Goldman says, will generate $23.3bn in 2030, up by a substantial $3.6bn on the investment bank’s prior 2030 forecast.

Despite the current pandemic, Goldman also thinks ad-funded music streaming revenues will grow by $900m in 2020, from $6.1bn to $7.0bn – not far off the $1.1bn growth the category saw in 2019.

Forecast annual paid subscription revenues for 2030 have been reduced by Goldman (dropping by $2bn on its prior forecast, to $51.9bn) in light of those ARPU adjustments.

The firm says overall (net/wholesale) industry revenues will hit $44.6bn in 2030, a slight decrease (-$200m) on its prior forecast.

And yet, as previously mentioned, Goldman now believes that there will be more paying music subscribers by 2030 (1.22bn) than it did before (1.15bn).

[How can it be that Goldman’s paid streaming – and total streaming – prediction for 2030 is higher than its overall recorded music forecast? Because, again, the latter refers to wholesale revenues going to labels and artists, while the former refers to retail revenues being paid by consumers to the likes of Spotify. Goldman explains: “We believe record labels will be the largest beneficiaries of the growth of music streaming given they receive 52%-58% royalty rates from the major DSPs — we expect no major change to these rates in the near term given the competitive dynamics amongst the DSPs.”]

There’s loads of other interesting research and predictions in the newly-updated, 80-page Music In The Air – too many to cover here – but those working in music publishing might like to learn that Goldman is also forecasting a 3.5% YoY rise in publishing industry revenues in both 2020 and 2021, despite the impact of the pandemic.

That’s because, says Goldman, “[we] expect music publishing will be slightly more resilient given its diversified revenue streams and lag in revenue recognition”.

As for live music, as you’d no doubt expect, 2020 is looking like something of a write-off, with Goldman suggesting that total global live revenues (across ticketing and sponsorship) will tumble to just $7bn in 2020, down from its pre-COVID forecast of $28.8bn.

However, Goldman is also forecasting that the live industry will rebound to $29.1bn global annual revenues in 2023, and is sticking to an unchanged prediction that this number will rise again to $38.7bn in 2030.

One more game-changing forecast to leave you with: 12% of the global music industry’s 341m paying streaming subscribers in 2019 were based in China, says Goldman (citing IFPI data), while double that share (24%) were based in the US.

Goldman Sachs now predicts that, by 2030, China will claim the biggest share of the world’s music streaming subscribers, with 20% of those 1.22bn subs, while the United States will sit in second place, on 13%.

The MBW Review is supported by Instrumental, which powers online scouting for A&R and talent teams within the music industry. Their leading scouting platform applies AI processes to Spotify and social data to unearth the fastest growing artists and tracks each day. Get in touch with the Instrumental team to find out how they can help power your scouting efforts.Music Business Worldwide

The MBW Review is supported by Instrumental, which powers online scouting for A&R and talent teams within the music industry. Their leading scouting platform applies AI processes to Spotify and social data to unearth the fastest growing artists and tracks each day. Get in touch with the Instrumental team to find out how they can help power your scouting efforts.Music Business Worldwide

No comments:

Post a Comment