[This is cross posted from Artist Rights Watch]

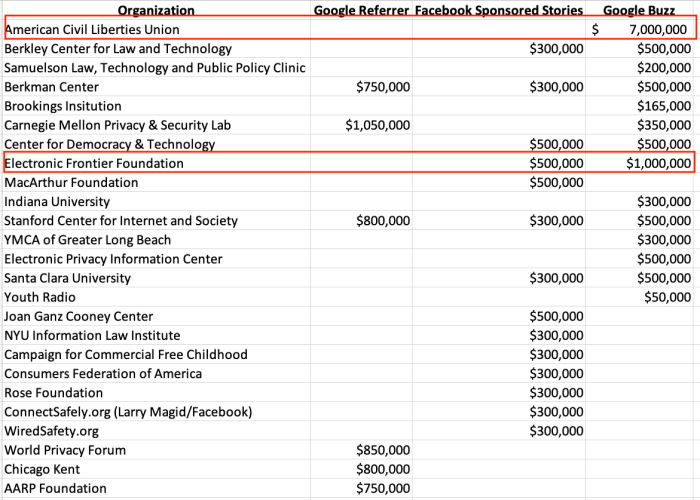

TikTok seems more likely to be shut down in the US with every passing day. How could this actually happen and what would “shut down” actually look like? Given that TikTok is a massive infringer, we will lose no sleep if they find themselves in real trouble. Still, it won’t be easy, particularly since the ACLU and Electronic Frontier Foundation (and other usual suspects who received Google and Facebook largesse) will no doubt rush to their defense. I’ll do a little prognosticating with the “over/under” that will necessarily entail some speculation about the future political environment.

Here are a few ideas, but my bet is that if it happens at all, it will be a combination punch. One thing we know for sure is that TikTok’s chief lobbyist in Washington, Michael Beckerman (the Shoe Man) will be earning his millions. Here’s a look at the old jab jab cross.

The Ghost Ship: If TikTok were determined to be a front for a foreign government (this time the Chinese Communist Party), Americans could be prohibited from working for TikTok and advertisers could be prohibited from doing business with the company under the International Emergency Economic Powers Act 50 U.S.C. § 1701. There are several different angles from espionage to election meddling to compromising Hong Kong, Tibetan, Taiwan or Uyghur human rights, or the decertification of Hong Kong.

If the shutdown is given effect under the International Emergency Economic Powers Act, it’s likely that installed versions of the TikTok app would continue to work, but would gradually degrade in user experience as the U.S. installed base could not lawfully be supported.

Over/Under: This approach would be a great opportunity for TikTok to launch a Napster-style PR campaign. They would probably let themselves be sued by the U.S. Government and hope to drag out the case to see if a more sympathetic Vice President Biden is elected (particularly given the recent history of the Obama Foundation) and Big Tech’s jockeying for position in the Biden campaign.

Et Tu CFIUS? The US Government reviews significant asset sales to foreign investors (including state owned enterprises) that implicate national security. This review is given effect in part through the Committee on Foreign Investment (CFIUS). CFIUS is currently reviewing the acquisition of Musical.ly by TikTok parent Bytedance, a process that began on November 1, 2019. It is possible that an acquirer like Bytedance can ask for a pre-clearance from CFIUS and–are you ready? Bytedance did not seek that pre-clearance, which requires explaining why the target’s business implicates national security like handing over user data to China’s State Security agency. Which is the very thing that is required by China’s National Intelligence Law but that TikTok denies doing. And is also probably the subject of at least one FBI counterintelligence investigation at this very moment.

Over/Under: This CFIUS investigation is ongoing, so will likely conclude. CFIUS can require that the Musical.ly acquisition be unwound. That would mean that the government could force a sale of TikTok (probably its US assets) or require TikTok to cease operations in the US. CFIUS has also forced Chinese investors to divest from PatientsLikeMe and Grindr. The CFIUS option has both precedent and is already in motion. I like this option as an opening gambit as it would happen in the background as far as TikTok users are concerned. Since Facebook is already trying to get licensed and also get in TikTok’s business, a sale would be relatively easy to accomplish.

No TikTok IPO For Bytedance: Like the CFIUS review, there is already a process in play in the Congress that will make a U.S. TikTok IPO much less attractive to Bytedance. The Holding Foreign Companies Accountable Act (S. 945) that unanimously passed the Senate on May 20 and was introduce in the House by Brad Sherman (D-CA) as H.R. 7000 where it is also expected to pass. It will be very interesting to see who votes against it.

It shouldn’t be surprising that China’s President-for-Life Xi Jinping doesn’t like his public companies being audited by U.S. public accounting firms and held to the same standards as all the other public companies. You know, Sarbanes Oxley and all that jazz.

For reasons that are difficult to fathom, China somehow managed to finagle a pass on SarBox compliance in 2013–ahem–that has been decried far and wide (recently by Arthur Levitt, President Clinton’s SEC chairman). According to Reuters, “The audit-quality issue has been festering since 2011, when scores of Chinese firms trading on U.S. exchanges were accused of accounting irregularities.”

According to Bloomberg the Holding Foreign Companies Accountable Act says:

If a company can’t show that it is not under [control of a foreign government] such control or the Public Company Accounting Oversight Board, or PCAOB, isn’t able to audit the company for three consecutive years to determine that it is not under the control of a foreign government, the company’s securities would be banned from the exchanges.

Bloomberg also tells us:

Stricter U.S. oversight could potentially affect the future listing plans of major private Chinese corporations from Jack Ma’s Ant Financial to SoftBank-backed ByteDance Ltd. But since discussions on increased disclosure requirements began last year, many other Chinese companies have either listed in Hong Kong already or plan to do so, said James Hull, a Beijing-based analyst and portfolio manager with Hullx.

“All Chinese U.S.-listed entities are potentially impacted over the coming years,” he said. “Increased disclosure may hurt some smaller companies, but there’s been risk disclosures around PCAOB for a while now, so it shouldn’t be a shock to anyone.”

Why would they list on Hong Kong when they are already listed on NY? Because they anticipate getting dumped from NY and they will still trade on the Hong Kong exchange for all the suckers.

Over/Under: TikTok could become the poster child for holding foreign companies accountable. HR 7000’s sponsor is Representative Brad Sherman who is a crack CPA and knows his way around this issue. Representative Sherman is also Chair of the powerful House Financial Services Subcommittee on Investor Protection, Entrepreneurship and Capital Markets so it’s likely that the legislation will pass out of the House, although Mr. Beckerman and the vast network of CCP lobbyists and consultants will have their work cut out for them. Trump would sign this bill faster than you can say “Rosatom”. By denying Bytedance (and Softbank) access to the U.S. capital markets, it would weaken the incentive for TikTok to fight a ban in court as the legislation is unrelated to a ban. Legislative action could not be easily reversed in a Biden Administration (who was in the White House when China got the exemption that the bill would now fix).

Criminal RICO: TikTok may well be determined to be a racketeering organization and a criminal conspiracy for massive copyright infringement as a RICO predicate, not to mention potentially violation of the Export Administration Regulations for exporting data to a foreign country with a military purpose as evidenced by China’s National Intelligence Law. It would at least be worth convening a grand jury to investigate.

Over/Under: There is no doubt that TikTok has plenty of RICO predicates and a high likelihood of conspiracy to commit any one of a number of things including copyright infringement.

Under RICO (18 U.S.C. § 1961–1968) the racketeering predicate is defined thusly–so what do you think?:

As used in this chapter—(1)“racketeering activity” means (A) any act or threat involving murder, kidnapping, gambling, arson, robbery, bribery, extortion, dealing in obscene matter, or dealing in a controlled substance or listed chemical (as defined in section 102 of the Controlled Substances Act), which is chargeable under State law and punishable by imprisonment for more than one year; (B) any act which is indictable under any of the following provisions of title 18, United States Code: Section 201 (relating to bribery), section 224 (relating to sports bribery), sections 471, 472, and 473 (relating to counterfeiting), section 659 (relating to theft from interstate shipment) if the act indictable under section 659 is felonious, section 664 (relating to embezzlement from pension and welfare funds), sections 891–894 (relating to extortionate credit transactions), section 1028 (relating to fraud and related activity in connection with identification documents), section 1029 (relating to fraud and related activity in connection with access devices), section 1084 (relating to the transmission of gambling information), section 1341 (relating to mail fraud), section 1343 (relating to wire fraud), section 1344 (relating to financial institution fraud), section 1425 (relating to the procurement of citizenship or nationalization unlawfully), section 1426 (relating to the reproduction of naturalization or citizenship papers), section 1427 (relating to the sale of naturalization or citizenship papers), sections 1461–1465 (relating to obscene matter), section 1503 (relating to obstruction of justice), section 1510 (relating to obstruction of criminal investigations), section 1511 (relating to the obstruction of State or local law enforcement), section 1512 (relating to tampering with a witness, victim, or an informant), section 1513 (relating to retaliating against a witness, victim, or an informant), section 1542 (relating to false statement in application and use of passport), section 1543 (relating to forgery or false use of passport), section 1544 (relating to misuse of passport), section 1546 (relating to fraud and misuse of visas, permits, and other documents), sections 1581–1592 (relating to peonage, slavery, and trafficking in persons), section 1951 (relating to interference with commerce, robbery, or extortion), section 1952 (relating to racketeering), section 1953 (relating to interstate transportation of wagering paraphernalia), section 1954 (relating to unlawful welfare fund payments), section 1955(relating to the prohibition of illegal gambling businesses), section 1956 (relating to the laundering of monetary instruments), section 1957 (relating to engaging in monetary transactions in property derived from specified unlawful activity), section 1958 (relating to use of interstate commerce facilities in the commission of murder-for-hire), section 1960 (relating to illegal money transmitters), sections 2251, 2251A, 2252, and 2260 (relating to sexual exploitation of children), sections 2312 and 2313 (relating to interstate transportation of stolen motor vehicles), sections 2314 and 2315 (relating to interstate transportation of stolen property), section 2318 (relating to trafficking in counterfeit labels for phonorecords, computer programs or computer program documentation or packaging and copies of motion pictures or other audiovisual works), section 2319 (relating to criminal infringement of a copyright), section 2319A (relating to unauthorized fixation of and trafficking in sound recordings and music videos of live musical performances), section 2320 (relating to trafficking in goods or services bearing counterfeit marks), section 2321 (relating to trafficking in certain motor vehicles or motor vehicle parts), sections 2341–2346 (relating to trafficking in contraband cigarettes), sections 2421–24 (relating to white slave traffic),sections 175–178 (relating to biological weapons), sections 229–229F (relating to chemical weapons), section 831 (relating to nuclear materials), (C) any act which is indictable under title 29, United States Code, section 186 (dealing with restrictions on payments and loans to labor organizations) or section 501(c) (relating to embezzlement from union funds), (D) any offense involving fraud connected with a case under title 11 (except a case under section 157 of this title), fraud in the sale of securities, or the felonious manufacture, importation, receiving, concealment, buying, selling, or otherwise dealing in a controlled substance or listed chemical (as defined in section 102 of the Controlled Substances Act), punishable under any law of the United States, (E) any act which is indictable under the Currency and Foreign Transactions Reporting Act, (F) any act which is indictable under the Immigration and Nationality Act, section 274 (relating to bringing in and harboring certain aliens), section 277 (relating to aiding or assisting certain aliens to enter the United States), or section 278 (relating to importation of alien for immoral purpose) if the act indictable under such section of such Act was committed for the purpose of financial gain, or (G) any act that is indictable under any provision listed in section 2332b(g)(5)(B)…. (emphasis mine)

[from https://ift.tt/2llz3cO]

No comments:

Post a Comment